are dental implants expenses tax deductible

7 Dental At-a-Glance Benefit Category High Option Classic Option Low Option Annual Deductible per personper family 50150 2575 2575 Annual Maximum per covered person. In ME waiting periods are waived for Class II and Class III if under the age of 19.

Medicare Part D 2021 Medicare How To Plan Medicare Advantage

This type of FSA is offered by most employers.

. If so you might want to contribute an additional. Braces Crowns and dentures. While the benefits and costs of dental insurance plans can vary significantly there are.

Lets look at what can and cannot be claimed on your tax return as well as how to claim these expenses. Dental plans apply standard waiting periods to covered basic 6-months major 12-months orthodontic 12-months and dental implant 12 months dental care services. Deductible for dental plan.

It would be great if these procedures were all tax deductible but this is not always the case. School and education special. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

Plans starting from 6194 per person per month. The cost of dental care can be high but dental insurance aids in offsetting some of those expenses. Refer to the policy or outline of coverage for details.

Dental implants can range 3000 to 4500 and full-mouth periodontal surgery can cost 4000 to 10000. However consolidating expenses into a single year yields the most savings. The plan pays 50 of the cost of basic and major care after you meet the deductible up to 1250 a year.

Here are some popular medical expenses that may be tax deductible. Sales tax shipping and handling fees for. 50 deductible max 3 per family.

Dental services paid to a medical practitioner. Delta Dental covers 100 of diagnostic and preventive services with no deductible. But you can always check with your HSA provider.

Waiting periods may vary by state. The savings can add up as these expenses can cost thousands of dollars. Osteopath Psychologist Psychiatric Care.

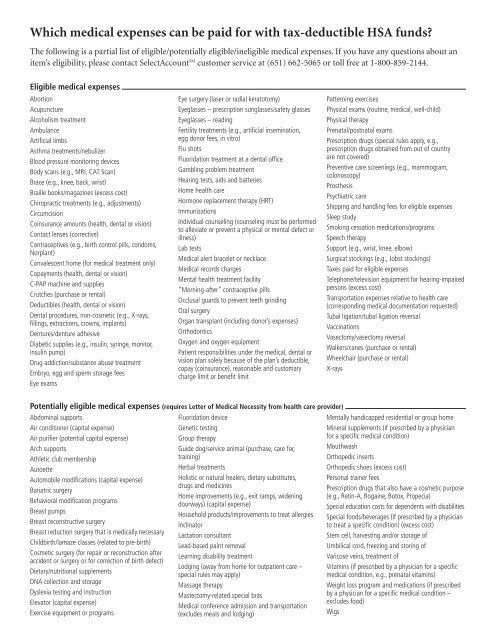

FSAs and HSAs can cover many dental expenses such as oral surgery implants and braces. Plans for seniors range from 36 to 74 per month and the maximum annual benefits range from 1200 to 5000. Full-mouth restoration pricing starts at 10000 and ranges higher.

It covers medical dental vision and pharmacy expenses. You may also be eligible to deduct the following dental and vision expenses. Many dental plans categorize implants as cosmetic because other less expensive artificial teeth exist such as dentures.

Diagnostic services dental or vision. Dental oral and teething pain products over-the-counter Dentures bridges etc. You could be out thousands of dollars for dental implants dentures bone grafts tooth extractions or.

Eligible expenses include health plan co-payments dental work and orthodontia eyeglasses and contact lenses and prescriptions. Expenses for purely cosmetic procedures are not eligible. There is no coverage for orthodontia or dental implants.

It does not cover major services including crowns bridges implants dentures or repair of crowns bridges and dentures. This lets us find the most appropriate writer for any type of assignment. 2500 in dental benefits per calendar year.

Premium Tax Credit Caps for 2022. Even with health insurance dental work can still come at a significant cost. Dental care for non-cosmetic purposes including sealants Dental reconstruction including implants Dental veneers.

For example lets say your high-deductible health insurance plan has a deductible of 3000 and your projected medical expenses are 3500. I cant see an instance where you wouldnt be able to use HSA funds for dental implants. Covered by the dental plan on a pre-tax basis.

Deductible for vision plan. Costs and Tax-Free Savings. The PPO plan pairs with any healthcare FSA or HSA for out-of-pocket expenses.

Delta Dental does not use ID cards. Costs are based on a 15- to 18-month treatment period that also helps to correctly align the jaw. And if you have a high deductible health plan HDHP you can fund a Health Savings Account HSA with pre-tax money and use it on a range of healthcare costs including dental.

For plan details see Benefits Summaries. Coverage for basic and major restorative services like fillings crowns bridges root canals and implants 3. Dental implants are tax-deductible meaning the IRS might offer significant discounts to seniors on Medicare with extensive physical and oral health expenses.

Under IRS rules an HSA will cover dental implants even though the industry often classifies them as cosmetic. Dental expenses can be a big part of an individuals or a familys medical expensesDental procedures such as root canals fillings and repairs and braces can run into the hundreds and even thousands of dollars. 100 lifetime deductible.

Veneers are covered only when medically necessary. The Medical Expense Tax Credit METC is a non-refundable tax credit that you can use to reduce the tax that you paid or may have to pay. The IRS determines which expenses are eligible for reimbursement.

Pays 10 after deductible for major services including dental implants day one 40 after deductible after 1 year Pays 50 for childrens orthodontics after 12 months up to 1000 lifetime max 2000 calendar year max benefit. Dentures and dental implants can be claimed without any certification or prescription. 0 dental check-ups including cleanings and routine x-rays 2.

Devices or software designed to allow a person who is blind or has a severe learning disability to read print prescription needed. The following are dental expenses that are typically covered by an FSA or HSA. Regular 0152-30050 Transit 0037-0001Full-time full benefits and part-time full benefits and 0152-30030 Part-time partial benefits Sheriff 0285-00000.

Sales tax on qualified medical expenses eg OTC medications Yes. Choose from an array of benefit options that include access to network providers that can help keep the cost of your care affordableWe can help you find the coverage you need online over the phone or face-to-face with a local agent all at no additional cost to you. Mastication cutting mixing and grinding ingested food.

15 discount for each dependent added to your policy. Most non-cosmetic dental expenses are tax deductible. You can claim eligible dental expenses paid.

The procedures restore function to missing teeth. The steep price means you could. This includes fees paid to dentists for X-rays models and molds fillings braces extractions dentures dental implants and the difference in cost from insurance-approved restorations and alternative materials etc.

Spirit Dental is a broker for Ameritas dental plan and is backed by Ameritas Life Insurance company. Option 1 does not cover basic services such as fillings root canals or oral surgery for the treatment of gum disease. Delta Dental contact information.

Keep in mind that cosmetic procedures such as teeth whitening are not. HealthMarkets makes it easy to get low cost dental or vision plans that fits your individual needs and your budget. Dental treatment - Medical expenses for dental treatment are reimbursable.

Note you cant use. Out-of-Pocket Maximums and Deductible Limits For 2021.

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Are Dental Procedures Tax Deductible Spanaway Dental Wellness

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

Are Dental Implants Tax Deductible Atlanta Dental Implants

Tax Deductions For Dental Care

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

/GettyImages-184878144-fad59359c24245ceb97dafe44c6d0e9e.jpg)

Is Dental Insurance Tax Deductible

Printable Fax Cover Sheet Pdf Blank Template Sample Fax Cover Sheet Cover Sheet Template Cover Pages

Spring Cleaning 20 Hidden Tax Deductions You Ll Be Glad You Found 2022 Turbotax Canada Tips

Are Dental Veneers And Implants Tax Deductible

Is Cosmetic Dentistry Tax Deductible American Cosmetic Dentistry

Are Dental Implants Tax Deductible Drake Wallace Dentistry

Are Dentist Bills Tax Deductible

Hsa Tax Deduction How Your Hsa Can Lower Your Taxes

Which Medical Expenses Can Be Paid For With Tax Deductible Hsa

Dental Implant Cost Costa Mesa How Much Does Single Tooth Implant Cost In Orange County Dentistry At Its Finest

Does Major Dental Work Count As A Deduction For Income Tax

Can You Deduct The Cost Of Dental Care In Costa Rica On Your Taxes